Contents

If you are considering participating in an ICO or are uncertain about the validity of an ICO you are considering, we encourage you to seek professional advice or a second opinion. Depending on the circumstances of the ICO, the tokens may be securities. If you are uncertain, if securities laws apply to the ICO or the tokens you are considering, contact FCNB. There are income tax implications in using cryptocurrency to generate income, capital gains or to pay for goods or services.

The NDAX. IO platform is specially designed for beginners with its easy-to-use platform. The CoinSmart platform provides four deposit methods, including credit and debit cards. The processing of these kinds of transactions is instantaneous, but the fees can be up to 6% of the deposits. You can also choose between bank transfers, Interac e-transfers or bank cheques. For these transactions, the processing is done on the same day, with 0% fees.

There are dozens of exchanges that operate in Canada, including big names like Coinbase and Gemini. These exchanges give you a straightforward and convenient way to sell your Bitcoin as quickly as possible. Some more exchanges also give you the option to input a minimum sell value , so that you won’t get short-changed on your Bitcoin. Your first option for getting cash for your Bitcoin is to sell your crypto on an exchange. In general, you’ll find that there’s a trade-off between convenience and cost-effectiveness when cashing out Bitcoin.

Regulatory and Legal

With cryptocurrency, only you have access to your funds, and no one else can touch it. With conventional cash, you naturally give all the control cryptocurrency broker canada to the government and central bank. And you know that at any point, they can deny you access to your funds by freezing your account.

Instead of a person or company owning an inventory of digital currencies and selling them to brokers, an AMM automates the entire process, allowing you to trade currencies with no human intervention. Instead of relying on traditional digital currency markets, buyers and sellers use liquidity pools, which remove intermediaries from the trading process. Our expertise in related sectors makes BLG well poised to provide digital asset advice. Bitvooffers 11 different cryptocurrencies and is one of the only exchanges to offer a Canadian Dollar backed stablecoin called QCAD.

A collapse in demand for a cryptocurrency may result in you losing all or most of your investment. Although many are decentralized, some are operated by one or more parties with centralized control. Although they are commonly referred to as “cryptocurrencies”, this can be misleading, as to date, they have not been legal tender under Canada’s Currency Act. In many cases, crypto-assets are subject to securities law in Canada. Distributions, if any, are treated as reinvested, and it does not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder.

Interactive Brokers Expands Cryptocurrency Trading

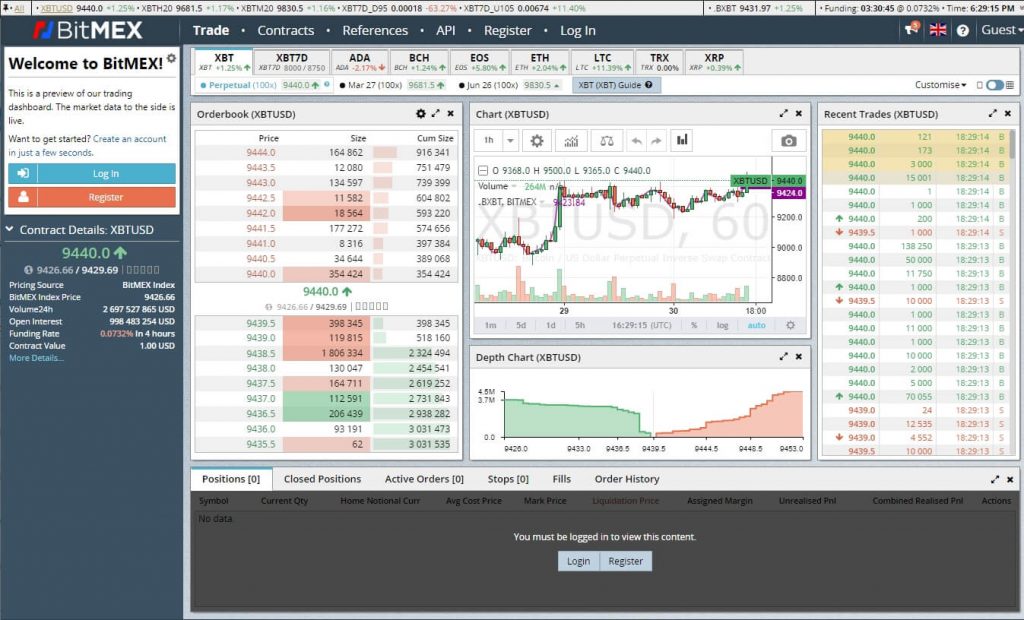

Many people have made fortunes with bitcoin trading but many people have lost a lot of coins from this cryptocurrency. Bitcoin is very unpredictable and it is not the best place to invest funds that you need. If you are interested, follow us through this article to get to understand how to use bitcoin, bank account transfer, buy bitcoin, and sell bitcoin. An order book provides an electronic representation of the trading activity of an asset on a specific trading platform.

Cryptocurrencies that are pegged to an external reference or backed by a reserve asset are stablecoins. The reserve asset could be a traditional https://broker-review.org/ currency like the U.S. dollar or a commodity such as gold. This offers price stability, being pegged to a conventional, fixed currency.

Cryptocurrency

Digital money is sent from one person’s computer to another through a peer-to-peer database network. Unless I am mistaken they aren’t allowing bitcoin trading, they are allowing bitcoin futures trading, which is a very different thing. Even if they were up to date QuantConnect wouldn’t have more than a few days worth of bitcoin futures historical data to backtest with at this point. Represented the first registrant to obtain registration as an investment fund manager in Canada focused on cryptocurrency investments.

- Then, head on to Superprof and connect yourself with hundreds of tutors near you.

- You are more likely to have a positive experience from a platform with strong customer reviews.

- Unregistered platforms operating in Ontario that are non-compliant may be included on the OSC Investor Warnings and Alerts Page and subject to regulatory action, including temporary orders.

- However, it is up to each broker to decide how he wants to secure his customer deposits.

- Deposit options include eTransfer, wire transfer, or as an online bill payment through your online bank account.

- Like most cryptocurrency exchange platforms these days, the user interface is easy to navigate and designed for both beginners and seasoned investors alike.

“We will continue to monitor this new direction and evaluate our marketing spend,” a General Mills spokesperson said. Audi of America, the Herndon, Virginia-based U.S. unit of Audi – a Volkswagen Group brand – said it would “continue to evaluate the situation.” TOKYO -Japan will ask the United States to be more flexible on electric vehicle purchase incentives for non-American carmakers, Kyodo news agency reported on Friday, citing unidentified government sources. The move follows a statement from South Korea’s foreign ministry saying Seoul is seeking a three-year grace period on the U.S. Inflation Act to enable its automakers to continue receiving EV incentives in the United States.

BetaPro Inverse Bitcoin ETF

It is also what appears as the digital signature on a blockchain ledger. On the other hand, the private key is the password you need to buy BTC or sell bitcoin in a wallet. (Short for market capitalization.) Market cap measures and monitors the market value of a digital currency. Investors use this metric to benchmark the popularity and dominance of digital currencies to inform their trading strategies. Market cap isn’t the only indicator of how well a digital currency is performing, but it is the most popular for determining the relative size of a cryptocurrency.

However, fees for these exchanges can vary widely and some are quite expensive. Always double-check any potential fees before you confirm a sell order. Blockchain funds are similar to other investment funds that invest in a particular industry or sector of the economy. In this case, blockchain funds invest only in companies that have operations related to blockchain technology. ICOs are high risk, and their structure makes them fertile ground for fraud and abuse.

The USA-based cryptocurrency exchange is regulated by the FinCEN in the USA and the FCA . Even in Australia they are regulated by the AUSTRAC and in Japan by the FSA. When leverage is used there is an additional fee that can occur – the funding fee. For example, if you decide to go long on BTCUSD, part of your deposit will be used to facilitate the trade. After closing it, the difference in price will be added or taken out of your initial deposit.

Anyone who sells or provides advice in securities or derivatives in New Brunswick must be registered with FCNB. Check registration by using the free National Registration Search tool from the Canadian Securities Administrators. Recently, scammers have been offering investment opportunities that claim to provide guaranteed returns and recruitment bonus compensation packages. These are often red flags of fraud and should be approached with caution.

Both are easy to use, easy to fund with CAD, and offer competitive trading and transaction fees. Bull Bitcoin is a Canadian cryptocurrency exchange platform that was founded in 2013. This handy platform is great if you’re only interested in Bitcoin because that’s the only crypto they offer. Plus, it’s a non-custodial platform that does not store your Bitcoin for you, making it a great choice if you want an easy way to trade Bitcoin and store it in your own private wallet.

BetaPro Inverse Bitcoin ETF gives investors the opportunity to potentially profit from a decline in the price of bitcoin futures. BetaPro ETFs use a corporate class structure and are designed to provide market-savvy investors with leveraged, inverse and inverse leveraged exposure to various indices or commodities on a daily basis. Also, there are some serious questions out there about the legality of selling crypto on a P2P platform. Some countries view selling on these marketplaces as a business activity, so you might need to be registered as a financial business to be able to do so legally.