Contents:

For instance, when the International Monetary Fund calculates the value of its special drawing rights every day, they use the London market prices at noon that day. Trading in the United States accounted for 19.4%, Singapore and Hong Kong account for 9.4% and 7.1%, respectively, and Japan accounted for 4.4%. For this reason, it’s vital to choose a forex broker that can offer you as many trading hours as possible. For example, a trader based in the UK, trading on the USD/AUD currency pair, for instance, will know that New York trading hours only start at 12pm UK time, while Australia’s trading day only begins at 9pm at night.

If you are unsure about the reliability of your Forex broker, you can check our list of brokers to avoid. If you believe you have been scammed by your broker, the first thing to do is contact the FCA. You can contact the FCA’s complaints department here, and they can advise you on the next steps to take. We also have a report a scam broker form which we use to gather information so that we get the word out.

Demo accounts last for 30 days, with the exception of demo accounts for cTrader – which do not expire provided that you log in at least once every 30 days. The following list of the best forex brokers are all regulated by the Financial Conduct Authority in the UK. They are listed in no particular order and are chosen based on their reputation, regulations, and financial stability, among others. Forex traders pay taxes in the UK but spread betting accounts can be tax-free.

Click here for a full list of our partners and an in-depth explanation on how we get paid. Very high level of regulation and reputation, and it offers a highly competitive fee structure which tends to keep down the cost of trading. The ratings shown on DailyForex.com are determined by hours of research from our editorial team into over 10 factors, including account fees, deposit/withdrawal options, regulatory status, tradable assets, and more. Our team of industry experts conducted our reviews and developed this best-in-industry methodology for ranking online platforms for users at all levels.Click here to read our full methodology. Founded in 2002 as Poland’s first leveraged foreign exchange brokerage house, X-Trade morphed into X-Trade Brokers in 2004 to comply with new Polish regulations. The company went public in 2007, listing on the Warsaw Stock Exchange under the ticker symbol XTB, and it was rebranded as XTB Online Trading in 2009.

This helps keep things running smoothly by ensuring customers receive payments in a time efficient manner. It has the added benefit of giving consumers confidence that the broker is solvent. Thankfully, as well as holding a list of registered brokers, it also has a compiled list of broker’s that should be avoided at all costs.

When spread betting, traders can easily trade both sides of the market and potentially profit from rising and falling markets. In spread betting, there are no commissions charged, and the cost of entering and exiting trades is reflected in the spread. Like CFD trading, spread betting is leveraged, and speculators can manage their risk using stop-loss orders. The depth of the product catalog places this broker in an elite group, and active traders especially may appreciate the tight spreads available. Competitive trading costs, an advanced proprietary platform, Metatrader4, and a massive range of tradable instruments make CMC Markets a strong choice for serious traders.

Best U.K. Forex Brokers

As we mentioned briefly, the UK https://trading-market.org/ market is accessible globally, and as it’s one of the biggest markets in the world, it’s accessed by a whole lot of people. Because of this, there is not just one organization that regulates and monitors the market. Instead, this is done by separate authorities, depending on the country of the trading account, who monitor the market on a more local scale.

According to some economists, individual traders could act as “noise traders” and have a more destabilizing role than larger and better informed actors. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. Other economists, such as Joseph Stiglitz, consider this argument to be based more on politics and a free market philosophy than on economics. Some investment management firms also have more speculative specialist currency overlay operations, which manage clients’ currency exposures with the aim of generating profits as well as limiting risk. While the number of this type of specialist firms is quite small, many have a large value of assets under management and can, therefore, generate large trades. Main foreign exchange market turnover, 1988–2007, measured in billions of USD.

Admiral Markets Pros and Cons

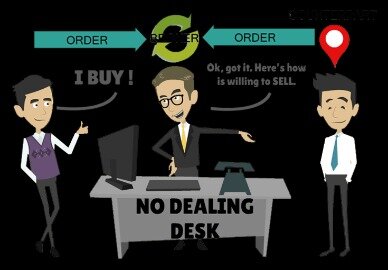

Other london forex brokers act as a go-between, taking orders from traders and sending them straight to the global Forex market. Both types of Forex brokers require a lot of money to set up and need teams of highly qualified technicians to maintain their trading platforms. IC Markets is rare amongst ECN brokers, as it provides a welcoming environment for beginner traders. IC Markets offers an archive of structured course material, detailed independent market analysis and expert-led webinars. IC Markets also provides excellent technical support for all three trading platforms 24/5 as well as more general queries.

Scalping the forex markets is a very popular form of trading as it involves trading in and out of positions very quicky trading to make short-term profits on very small price movements. The most you should expect to see on offer are between 50 or 60 combinations, although many brokers may have a more restrictive list than this. It is also worth noting that leverage ratios can be tighter in less liquid FX rates as well.

Innovative platform

For instance, If you open an account as a European investor through Plus500CY Ltd, you are protected up to €20,000. Additionally, Plus500 provides negative balance protection for CFD trading on a per-account basis – only to retail clients from the European Union. Interactive Brokers is one of the best options for experienced investors looking for advanced features and a high level of customization through the TWS platform . Additionally, the web version and the mobile app, IBKR GlobalTrader, are well-designed and more user-friendly for beginners. CMC Markets is a giant in the world of CFD trading, founded in 1989, long before forex trading became mainstream. The London-based broker is listed on the London Stock Exchange under the ticker CMCX.

Best Forex Brokers in Thailand – Finance Magnates

Best Forex Brokers in Thailand.

Posted: Mon, 19 Dec 2022 08:00:00 GMT [source]

In addition, AvaTrade offers full support for MT4 and MT5 (including EA’s, indicators, scalping and hedging) and provides free access to the integrated Trading Central dashboard for both platforms. Save yourself hours of research and check out our broker recommendation tool that will give you a tailor-made list of the best forex brokers available to you. When you trade forex on leverage and hold your position overnight, a fee will be charged.

Within the interbank market, spreads, which are the difference between the bid and ask prices, are razor sharp and not known to players outside the inner circle. The difference between the bid and ask prices widens (for example from 0 to 1 pip to 1–2 pips for currencies such as the EUR) as you go down the levels of access. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. The levels of access that make up the foreign exchange market are determined by the size of the “line” . The top-tier interbank market accounts for 51% of all transactions.

FP Markets Pros and Cons

For more details and Why trade with FCA Regulated Forex Brokers read the detailed article by the link. You trust the reputation and expertise of brokers from the world’s financial capital. You live in the United Kingdom and wish to benefit from tax-free spread betting. It is really important that you do not trade any money that you can’t afford to lose because regardless of how much research you have done, or how confident you are in your trade, there will always be a time that you lose. The FCA has the power to take action against any Forex broker that is found to be in violation of its regulations, including revoking their license to operate.

- Forex brokerage accounts work in slightly different ways depending on the region you trade in, so how it’ll work will be determined by which broker you choose.

- IG invented financial spread betting in 1974 and launched the first online dealing platform for financial spread betting in 1998.

- However, these days, it’s becoming increasingly automated and time-sensitive.

- This may be one of the most overlooked aspects of the overall product and service portfolio of UK-based Forex brokers.

We also give you negative balance protection.2 This means you can’t lose more than the equity available in your account. If your balance does go negative, we’ll bring it back up to zero at no cost to you. The reverse would be true if you went long and the share price dropped by 40 cents, you’d have made a $400 loss – double your initial amount paid.

Related Broker Guides

In most cases, we charge our own spread on top of the market spread, as our fee for the trade. Choose an STP forex broker that allows you to trade micro lots to start real trading with the least amount of risk and also to see if the EA performs properly well with that broker. Choosing an online forex broker is the first key step when you decide to start trading in the forex world. Our LCG series of trading videos are suited to beginners looking to learn more about CFD trading as well as the experienced trader looking to develop their strategies. From introductory topics such as what is forex through to advanced investment opportunities, our expert team has you covered. Whether you are a serious forex trader who requires professional performance and flexibility, or an investor who needs access on the go, we have the right platform for you.

All these developed countries already have fully convertible capital accounts. Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls. Countries such as South Korea, South Africa, and India have established currency futures exchanges, despite having some capital controls. The foreign exchange market assists international trade and investments by enabling currency conversion.

10 Best Forex Brokers in South Africa – Finance Magnates

10 Best Forex Brokers in South Africa.

Posted: Mon, 22 Aug 2022 07:00:00 GMT [source]

With FinecoBank, you can access 26 global markets and trade over 20,000 financial instruments worldwide on a single account, including forex, CFDs, UK and overseas shares, ETFs, funds, bonds, futures and options. FinecoBank offers a wide selection of cross-currency pairs, including the most important FX market pairs, EUR/USD, GBP/USD, GBP/JPY and AUD/USD. Users can also invest and trade directly in GBP, EUR, USD, CHF and 20+ currencies. ProCharts, a professional-grade technical analysis tool available via the software, enables you to compare charts from different financial instruments and time frames. The software also provides risk management tools, such as Stop Loss, Take Profit and Trailing Stop Loss, which you can use to better manage your positions, protect your investments and secure your profits.

It also matters whether different account features including leverage & margin, commission & spread, initial capital requirement, and ease of deposit and withdrawal can meet your trading needs. Yes, it is possible to make a living with forex trading, but it requires a lot of dedication, discipline, and experience. Forex traders who are successful make consistent profits over a long period by managing their risks and using a variety of trading strategies. For example, traders may use technical analysis to identify trends and support/resistance levels or fundamental analysis to analyse economic indicators and news events. With Saxo, you can invest in leveraged trading products such as forex, CFDs, futures, commodities and options, or cash investment products such as UK and overseas stocks and shares, bonds, and ETFs. IG has some of the most extensive market access, where you can trade over 18,000 financial instruments across several exchanges.

Here, a broker charges a monthly sum after an account has been dormant for a set number of months. In our individual broker reviews, we explain complex areas like regulatory status, so you can easily understand the safety of your funds and the benefits you are guaranteed. A wide variety of markets and instruments to trade, with over 2,500 available CFDs. Plus500 has invested heavily in its proprietary WebTrader platform, which has taken the ease of use to a new level.

At the start of the 20th century, trades in currencies was most active in Paris, New York City and Berlin; Britain remained largely uninvolved until 1914. Between 1919 and 1922, the number of foreign exchange brokers in London increased to 17; and in 1924, there were 40 firms operating for the purposes of exchange. Brown & Sons traded foreign currencies around 1850 and was a leading currency trader in the USA. Do Espírito Santo de Silva (Banco Espírito Santo) applied for and was given permission to engage in a foreign exchange trading business. These products are not suitable for all clients, therefore please ensure you fully understand the risks and seek independent advice.

If the money lost exceeds this amount, you can still only be awarded a maximum of £85,000. IG is a highly regulated and trusted broker across the globe, with an extensive list of tradable assets, an excellent platform and research tools, competitive rates, and leading educational material. City Index’s desktop platform, AT Pro is slightly more complex – it has a whopping 130 technical indicators, 25 drawing tools, as well as over 100 pre-loaded strategies, and an automated trading feature. This platform also boasts a clear fee report and a good selection of order types but it is a bit more daunting than the Web Trader, potentially making it a bad choice for beginners..

Many forex brokers hype that they offer highly competitive spreads to attract brokers. 84% of retail investor accounts lose money when trading CFDs with this provider.You should consider whether you can afford to take the high risk of losing your money. Over 12,000 CFD instruments can be traded including over 330 currency pairs, 19 cryptocurrency CFDs, 80 indices, 100 commodities, 10,000 shares, 1,000 ETFs, and 50 treasuries. Our hands-on tests during market hours showed that CMC Markets offers highly competitive spreads, as low as 0.7 pips in EUR/USD. 86% of retail investor accounts lose money when trading CFDs with this provider.